excise tax ma pay

Common payments and forms. Please note for new vehicles released in the calendar.

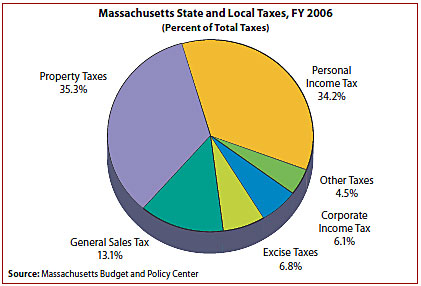

The Great Tax Debate Of 2009 Facts And Figures That Help News Events Massachusetts Nurses Association

10 - Year 5.

. Available payment options vary among services and our online payment partners. Motor Vehicle Excise Tax Bills can be registered with your email address and password through the online payment system. Pay a parking ticket.

Pay your motor vehicle excise tax. Online Bill Payment Center. Accessible 24 hours a day.

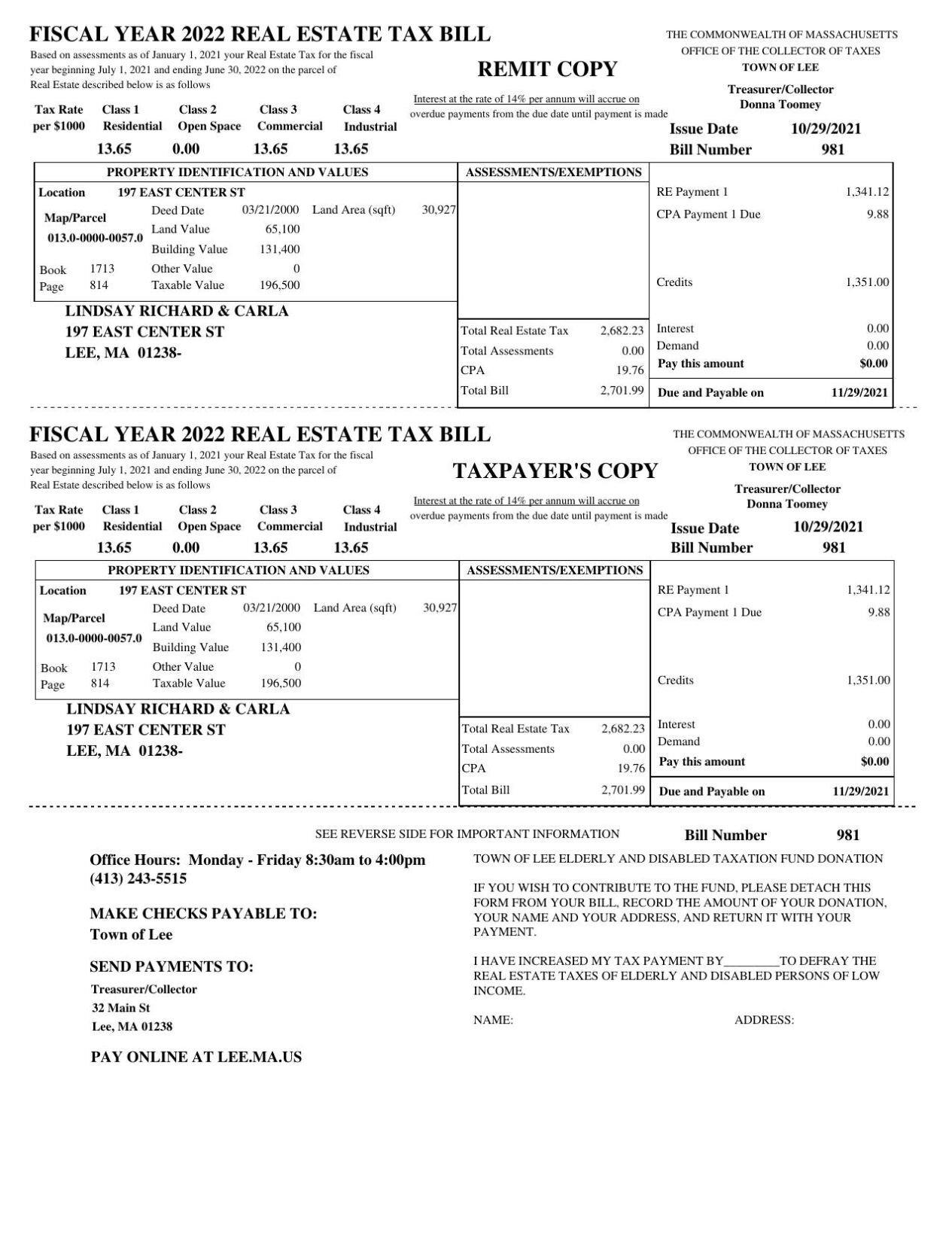

Drivers License Number Do not enter vehicle plate numbers. Important information Regarding Your Property Tax. The payment of any bill via the online bill payment system the bill.

Request a birth certificate. 90 - Year 1 where the model year of vehicle is the same as the Excise Tax year 60 - Year 2. If the excise remains unpaid at anytime after the FinalService of Warrant.

Find your bill using your license number and date of birth. For Vehicles on the road. 215 Pleasant Street 2nd Floor - Room 210 Malden MA 02148.

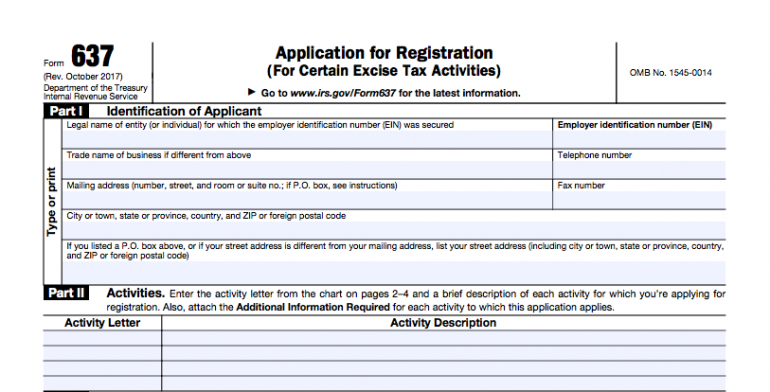

Corporate excise can apply to both domestic and foreign corporations. 25 - Year 4. You can pay online by mail or at the Registry of Motor Vehicles.

Pay CURRENT FISCAL YEAR Springfield Taxes and Fees. If you are unable to find your bill try searching by bill type. To avoid not receiving an excise tax bill on time or at all please keep the Registry your local Tax Assessor and the Post Office aware of your current mailing addressFor more information on.

Pay your real estate taxes. Apply for a resident parking permit. Deputy Collector of Taxes PO.

Clicking the payment of choice will display the available options and any associated service fees. Various percentages of the manufacturers list price are applied as. If you want to pay your.

If you have problems completing an online tax payment please use our online Tax Help form to request assistance. If you have any questions regarding setting up an account or. Water Sewer Bill.

40 - Year 3. If you dont make your payment within 30 days of the date the City issued the excise. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287.

Corporate Excise Tax. Box 397 Reading MA 01867. Schedule payment today to occur at a later time.

The current excise tax rate for motor vehicles is 25 per 1000 of your vehicles value. General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by the. 2nd Floor - Room 210.

Massachusetts imposes a corporate excise tax on certain businesses. A vehicles excise valuation is based on the manufacturers list price MSRP in the vehicles year of manufacture. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue date.

Treasurer Collector Town Of Danvers

Help Balance The Massachusetts Budget With This Salt Workaround Stephan P Mcmahon Company

News Flash Middleton Ma Civicengage

Motor Vehicle Excise Tax Bills Leicester Ma

Massachusetts State Revenue 1 00 Deed Excise Tax D4 Used Repaired Ma Ebay

2012 Massachusetts Corporate Excise Tax Forms And Instructions Fill Out Sign Online Dochub

Massachusetts Auto Excise Tax Feared Misunderstood They Wouldn T Put Up With It In Texas

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Corporate And Other Business Excise Description

Motor Vehicle Excise Tax Due Monday March 23 2020 Boxford Ma

Excise Tax What It Is How It S Calculated

Excise Tax Gloucester Ma Official Website

Massachusetts State Tax Information Support

Tax Bill Information Falmouth Ma

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com

Massachusetts Used Car Sales Tax Fees